Cash is king! We've all heard and probably even used this colloquial phrase. While we’re unsure of its origin, the phrase became popular after the global stock market crash in 1987. But the question that we’re asking today is, “Is cash still the king in India?”

If you live in Urban India, you would probably say no. But the story is quite different in the rural regions of our country. Here’s a personal anecdote from our CEO, V Balasubramanian.

During one of his tours, he happened to be passing through a village when he was being driven from one city to another. They stopped for tea in the village’s central area. Along with the tea stall, a couple of small food places and a grocery store, the area also had an ATM. He was intrigued to see some villagers milling around the ATM. There weren’t just men there, even women and children.

After watching them for a while, he realised why they were hanging around the ATM. An ATM cash van drove up to the site and the handlers started to replenish the ATM with cash. V Balasubramanian realised that this was what the villagers were waiting for. Cash replenishment in the ATM was a major event for them. He could see the joy on their faces.

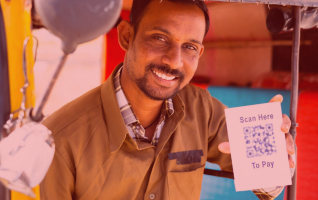

When he told us this story in one of our organisation’s townhall, V Balasubramanian equated the villagers’ joy with the kind of joy he used to feel while scanning a QR code to make a payment in the early days of UPI. Today, UPI transactions have become routine to us, but on the other hand, people in many parts of the country are still in awe of cash disbursals from ATMs.

The use of cash is still very much prevalent all through India, even after the advent and progress of digital payments. This is why all major and minor banks have plans to expand their ATM network. But just installing new ATMs is not enough, banks have to ensure that these ATMs are efficient as well. ATM efficiency, after all, directly impacts a bank’s bottomline.

To do this, banks need to partner with a company like FSS. As a technology-focused enterprise, FSS acknowledges the critical importance of integrating cutting-edge technologies such as the Internet of Things (IoT), Machine Learning (ML), and Artificial Intelligence (AI) into ATM systems and management.

Our software systems leverage these technologies to enhance the cost-effectiveness and efficiency of ATMs while increasing their uptime through the following three ways.

Identifying issues before they escalate

Consider FSS SwiftReach, our app-enabled ATM Hypercare service. With this initiative, we deploy a dedicated workforce for swift on-field responses. Our fleet includes over 400 Business Champions, with one assigned to every 30 ATMs. These champions conduct routine inspections and are trained to promptly analyze root causes at the ground level.

In case of unresolved issues, FSS SwiftReach automatically escalates the matter to the next level. Utilizing app-based technology ensures diligence in incident resolution, reduces reliance on vendor partners, and provides more accurate insights with broader field reach.

In the realm of ATMs, FSS SwiftReach excels at prevention, proving that preventing issues is more effective than curing them.

Taking timely action to address potential issues

FSS employs "A Third Eye," an AI-based intelligence surveillance system, which is a tech-enabled workflow that creates alerts for ATM site hygiene based on millions of trained images, achieving over 95% accuracy. Additionally, our on-

demand, real-time EJ Pulling Services, featuring simple file transfer scheduling and industry-standard encryption, proactively prevents frauds. This system is vendor-agnostic and adaptable to new ATM models.

Using data to anticipate failures

To further augment ATM monitoring, FSS adopts a predictive approach through IoT-enabled devices. These devices monitor individual equipment, from air conditioners to routers to UPS, predicting failures and issues. With 24/7 monitoring, 60% of issues are resolved instantly without deploying field agents, resulting in a 60% improvement in efficiency.

In summary, FSS utilizes technology to enhance ATM efficiency in day-to-day operations, leading to faster issue resolution and increased uptime. Our advantage in tech-enabled ATM services stems from in-house infrastructure, robust compliance, industry-level certifications, and a skilled and experienced resource pool.

With a three-decade legacy in the payments space, FSS stands as one of the top three ATM Managed Services companies in India, and the integration of modern technology will further enable economies at scale.

Find out more here: https://www.fsstech.com/atm-services/managed-service