Payment rails are the far-side of a payment transaction, the hidden layer which moves money between a payer and a payee. And just like with locomotive rails, there are multiple ways to transfer money from a payer to a payee.

When transfer is done via account rails instantaneously, it's called a real-time payment. Historically, the payment transaction communication has been one-sided and real-time payments bring end to end communication. Real-time payments connect the payment with payments data in real-time. The transformative power of instant movement of money and access to its data opens up avenues for offerings for both consumers and corporates that add value through improved customer experience and additional sources of revenue which were previously not available.

As we see standardization and instant payments becoming the norm, the market is opening to non-banks as well. So as the base rate for payments and bank revenues are declining, new entrants are conveniently picking the more profitable payments, leaving banks with declining revenues yet still loaded with the responsibility of funding the pipeline. Banks now need to seek new ways of making money from payments, and they are doing that by looking at value-added services to overlay on payment transactions. They are investing in building the infrastructure to support these services on real-time payment rails today to leverage the future scope of overlay services. Digital overlay services are offerings over-and-above the regular payment transaction performed on real-time payment rails which provide an ancillary service. Overlay services stand to benefit all parties – networks, financial institutions, and the end customer.

These services will enable banks charge the customers as well as provide with essential services, providing a one-stop shop to customers for all transactions. This will help banks retain the critical mass of their banking consumers, preventing them from looking elsewhere.

Enabling Commerce with Real-time Payment Rails

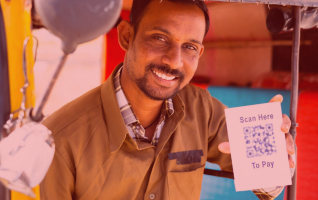

Merchants benefit from using instant payments at the point of sale instead of using a card. It benefits both the customer with payments happening on the fast lane within seconds which cards cannot achieve. For merchants, supermarkets have to pay an interchange fee for all card transactions which for every customer amount to significant charges. Instant payments eliminate all intermediary charges. In addition to that, usually cards have a separate loyalty scheme and the retailer usually does not get access to the data. Instant payments enables a retailer to collect data at the point of sale and offer overlay services in real time, unlike weekly or on daily basis. This also enables the possibility of introducing an open banking ecosystem. UPI can be used as a reference for open banking having also been implemented at a national level. The real reason this stands to work and scale successfully in all markets is because this will be done by banks, building robust scalable infrastructures with the help of payments technology providers and adopted nationally according to their regulations, leveraging the trust of existing banking users as well as provoking to bring the unbanked to the banking segment, all this while keeping the sensitive user information safe.

At the corporate levels, banks can offer real-time tracking of outbound and inbound payments, at any time of the day, 365 days a year. Services offered on the cloud with interactive dashboards will not only open new revenue streams but also enable innovative and forward-looking services, seeking inspiration from all the innovation happening in the personal finance space.

Banks have been in talks of implementing these services for a while now, and while there are several regulatory and technological challenges, the vision is quite clear and everyone acknowledges the evident shift to real-time payment rails. Rise of IoT based invisible payments, embedded payments, virtual cards at the point of sale or online etc. is disrupting the payments experience for the end consumer. At the same time, with new technology players looking to disrupt the space before banks, they do not have the liberty to wait too long lest they should lose the first mover advantage. The biggest challenge and opportunity are going to lie with the banks’ decision to pivot their revenue sources and stay profitable in the long run.

FSS Instant Payments

FSS Instant Payments is a fast, secure, 24/7 active, account-to-account electronic fund transfer solution designed to scale at a population level in a fast paced real-time payments environment. The solution acts as a PSP middleware and provides a modular approach to accommodate multiple payment journeys and provides API-based integrations for digital overlay services. Click here to learn more.